Back

February 1, 2024

Tax season is fast approaching, with Monday, April 15, 2025*, being the tax filing deadline for most Americans. In today’s article, we’ll break down some of the important considerations when looking at how to deal with the tax implications of your on- and off-chain crypto related activity. We’ll also take a look at and compare the most popular crypto tax software offerings.

*Those requesting an extension will have until Tuesday, October 15, 2025 to file.

A quick note from the Arch team

Depending on your crypto gains and trading activities, you may be sitting on a sizable tax liability. If you have the cash to handle the liability, then there is no problem. However, if you don’t, you may either need to sell other assets, incurring further taxes. An alternative to this is to take out a loan to meet the tax obligation. Taking out a loan allows you to continue to benefit from ownership of the underlying assets, and slowly pay back the loan overtime.

If you are coming up on needing to pay a large tax bill and have a size-able crypto portfolio, please reach out to us at support@archlending.com so we can help talk you through your options and see if a loan may be a good use case for you.

Crypto taxes

What types of activities are subject to taxes?

Crypto related income can come in several forms, all of which are subject to taxes:

The sale/swap of coins and tokens that have appreciated against their cost basis (the original price at which you bought them)

Crypto interest

Referral bonuses

Airdrops

Rewards from staking or mining

Wages paid out in cryptocurrency

How should I file my taxes?

Most people do not end up filing their taxes manually via paper. Instead, many end up using one or more of the standard filing solutions. The biggest e-filing solutions out there today are TurboTax, H&R Block, TaxAct, and TaxSlayer, but even the smaller, and cheaper FreeTaxUSA supports filing your crypto taxes.

However, depending on individual circumstances it may be preferable to work together with a professional tax accountant instead of using the above solutions. It really comes down to the individual circumstances.

When is crypto tax software necessary to aid in the filing?

Centralized exchanges such as Robinhood or Coinbase often send you a form 1099-B, which they also send to the IRS. This form can be used directly with e filing solutions or your tax accountant. However, this form may not accurately capture your tax liabilities if you have moved assets in and out of the exchanges. In this scenario you have to look at your transaction history in more all encompassing manner. This is also where crypto tax software ends up being especially helpful. Moving cryptocurrency from Robinhood or Coinbase into a non-custodial wallet does not represent a sale of these assets, and it’s very important that it doesn’t get labeled as a taxable event. By using these tools to integrate your on and off chain activity into a single view are you able to fully understand your tax liabilities.

If you didn’t move assets on and off exchanges, and say, just traded on Coinbase, there is a chance that you can save yourself from having to pay for crypto tax software all together, assuming your e-filing solution integrates well with your exchange of choice. In this case, the document provided by your exchange may be sufficient.

We’ll now turn to looking at what’s out there for people who need it.

Crypto tax software

All it takes is a Google search to realize that the crypto tax software space is just as competitive (if not more) than the normal e-filing space we discussed above. The first page on a normal desktop search is all ads:

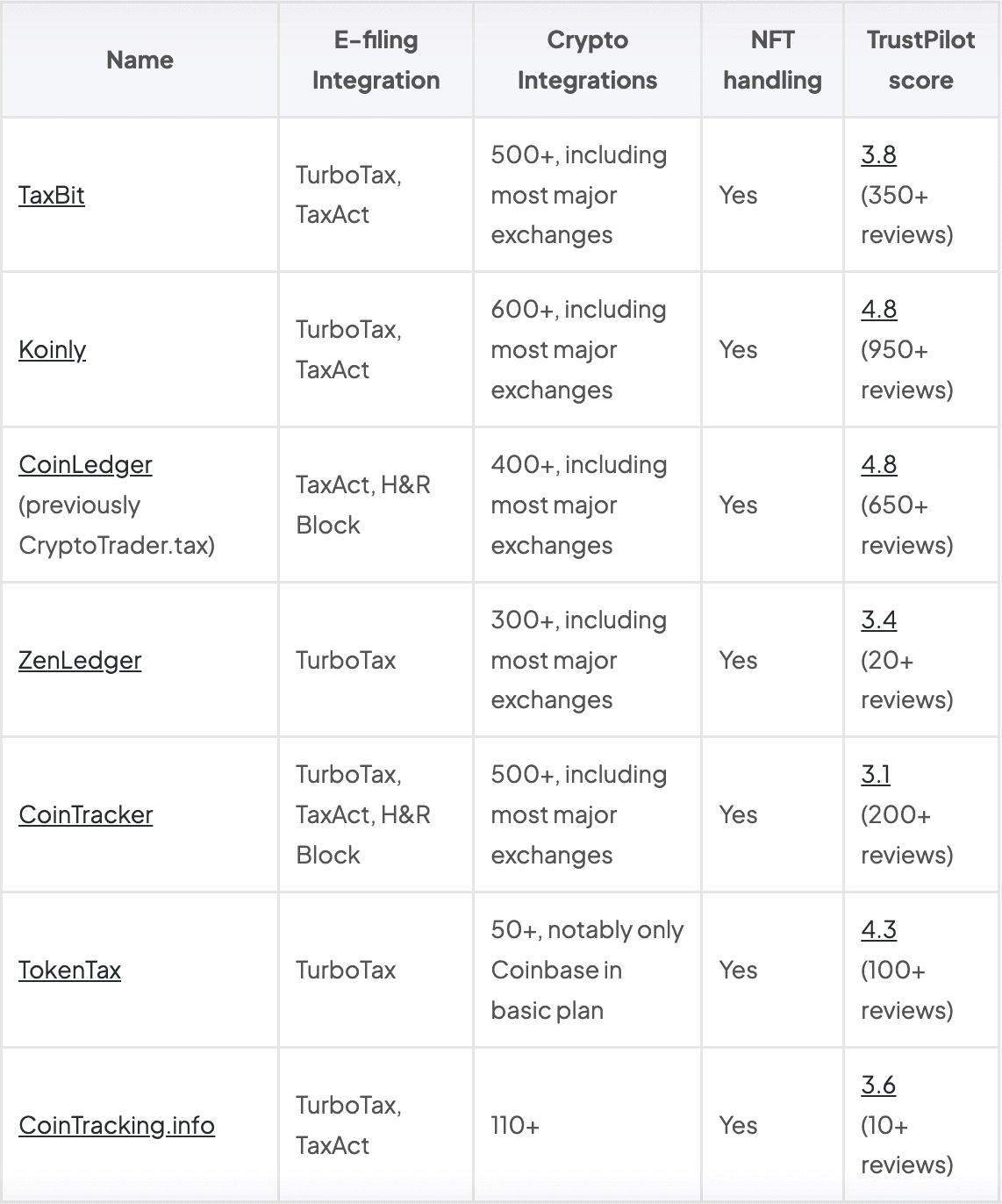

Competition is good for consumers, as these players will try to offer more and better features, while competing on pricing. Today, we’ll take a look at 7 of the biggest and most well known alternatives:

Note on E-filing integration: This covers only direct imports from the tax software, ultimately saving you a step of the process. You’re still able to take the generated 8949 document and upload into your e-filing solution.

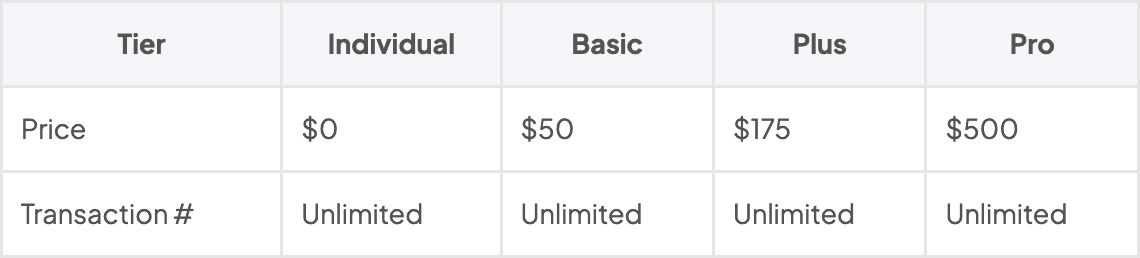

1. TaxBit

TaxBit is notable because it is free for individual users to use. They maintain a set of TaxBit Network (TBN) integrations that are fully supported with email available from their Customer Experience team. TaxBit also supports unlimited transactions, which can be a huge factor for those with lots and lots of historical transactions. It can be a good starting point before deciding if you want to move to another solution if certain needs are not being met. Aside from the free plan, a number of higher priced plans are available. The Pro plans comes with a free CPA session. While offered to anyone, TaxBit is focused on a US customer base.

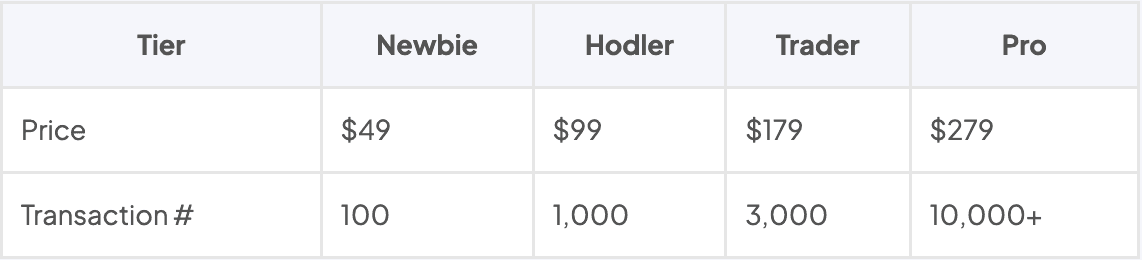

2. Koinly

Koinly offers the most extensive list of integrations and sources. The app doubles as a portfolio tracker you can revisit at any point during the year. Koinly supports tax reporting in a wide range of countries around globe.

In the app you can invite your own CPA to help go over the tax implications of your imported data.

With Koinly you also have the option to pay directly with crypto via Bitcoin or Ethereum blockchain (several tokens supported).

Koinly does offer a referral program ($25/referral) that can help alleviate the cost of the more premium plans. Refunds are available in certain circumstances if you’re not happy with the solution after paying.

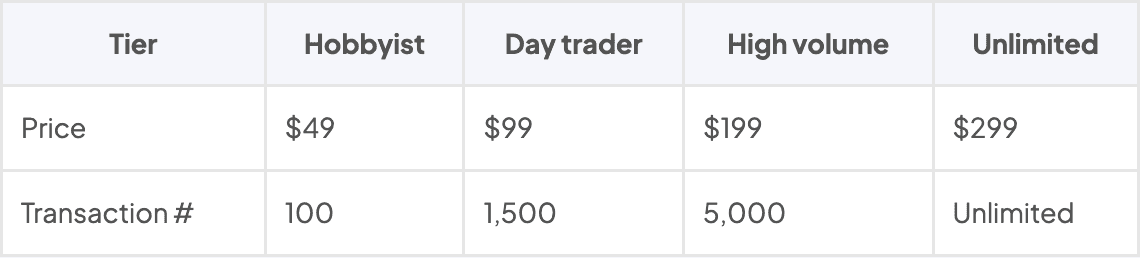

3. CoinLedger

CoinLedger was previously known as CryptoTrader.tax. It parses and handles transactions automatically, and even takes care of transactions involving NFT.

Additionally, it comes with tax loss harvesting tools built in. This can help you find opportunities to save money by planning your future trades.

CoinLedger has a program called “expert review”, where by someone will perform a complete audit of your account. You can also invite your own Tax Professional to the platform to give them access to your reports.

A full money-back guarantee is offered on all purchases. Their referral program lets you earn up to $75 for each person, and a 25% recurring commission.

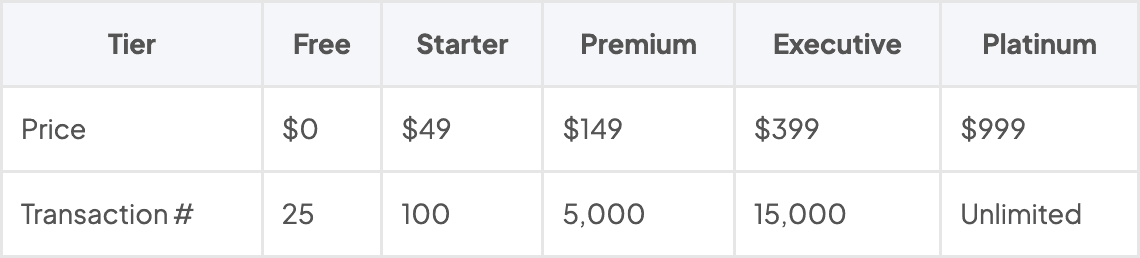

4. ZenLedger

ZenLedger has a product offering that’s similar to many others in this article. One thing worth noting is that support for DeFi, NFTs and staking is only available with the premium plan (see table below).

ZenLedger can help connect you with tax professionals for short consultations or a full tax report prepared by a professional. You can also invite your own tax professional. ZenLedger provides a Tax Loss harvesting report to help you plan your sales at the end of the year.

ZenLedger also has a referral program with a 20% commission.

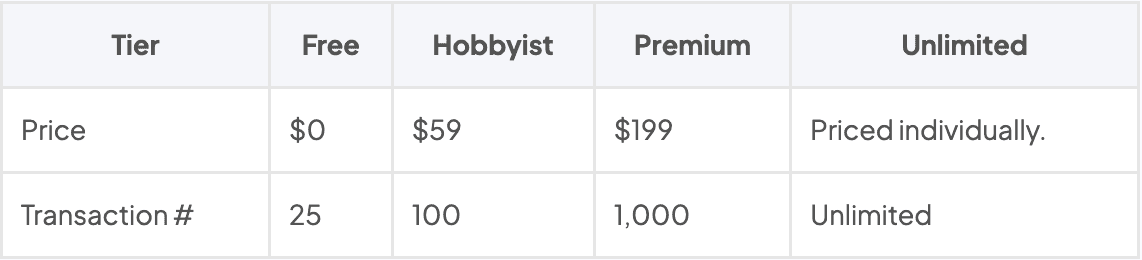

5. CoinTracker

CoinTracker offers a clean UI with an extensive set of integration points, and support for DeFi/NFTs. The app doubles as a portfolio tracker with a historical view of your holdings. The base portfolio product is pretty barebones, but they offer additional features via a subscription (this subscription is separate from the tax pricing below)

When it comes to tax reporting generation, the annual pricing is only counting transactions in the year for which you’re doing taxes, which can be really helpful for individuals with an otherwise light year of trading after previous years of extensive trading.

The app lets you invite a tax professional to get help, and tax loss harvesting features are available as well.

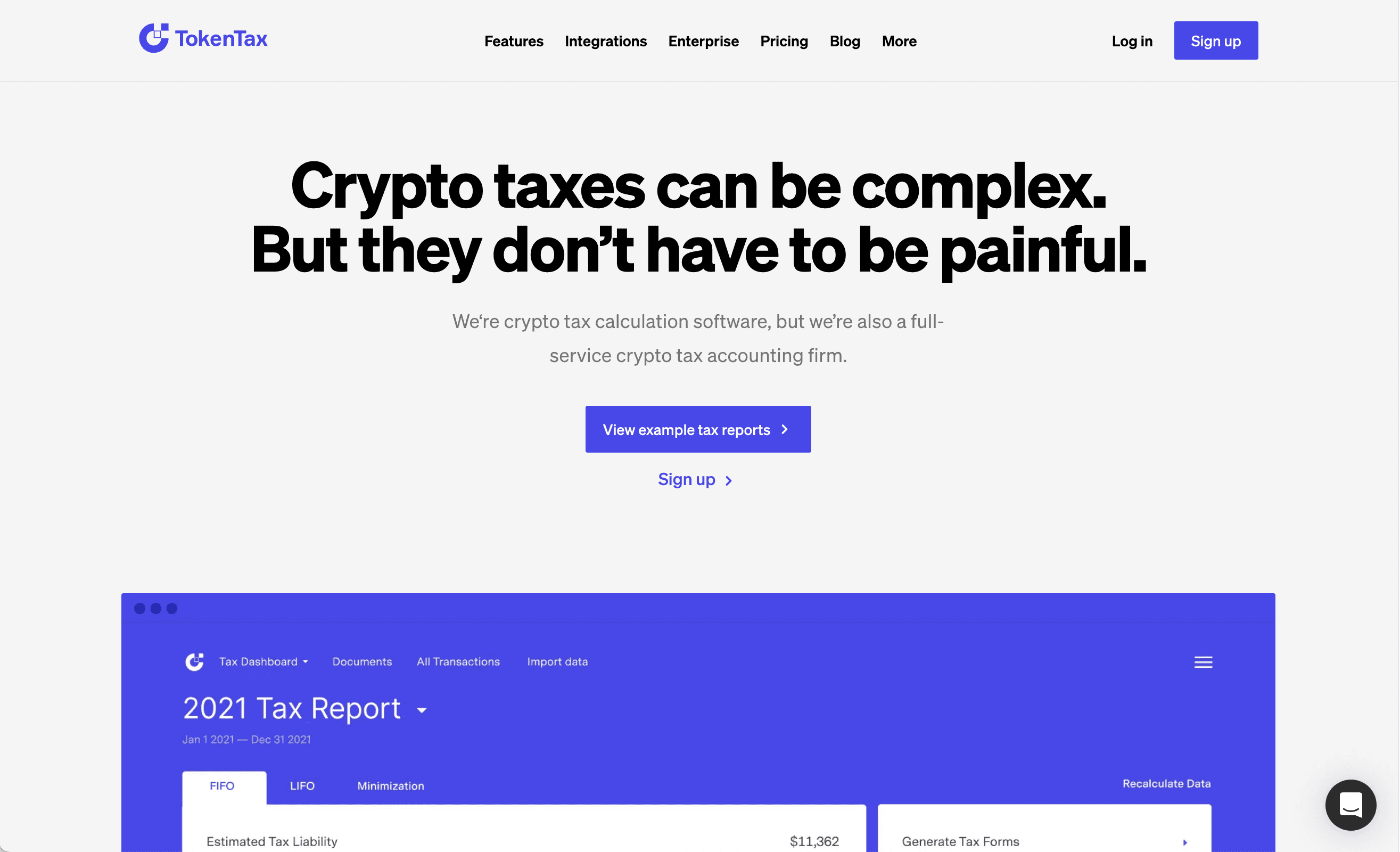

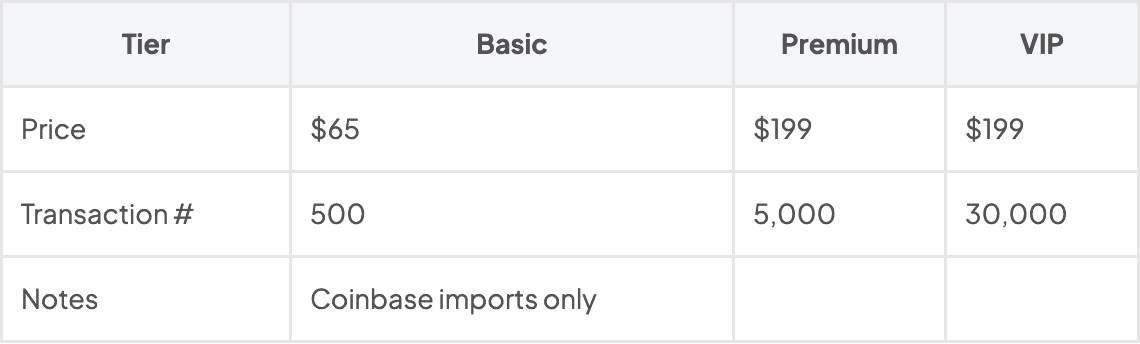

6. TokenTax

TokenTax offers an extensive set of integrations and have full-time certified accountants on staff to help with your taxes, if needed.

TokenTax is notable for being the only solution on this list not letting users upload or import data, and previewing the results, without first purchasing a plan. Further, there is a no-refund policy, meaning that unlike all other crypto tax software, you won’t be able to get an idea of the final result until after you pay.

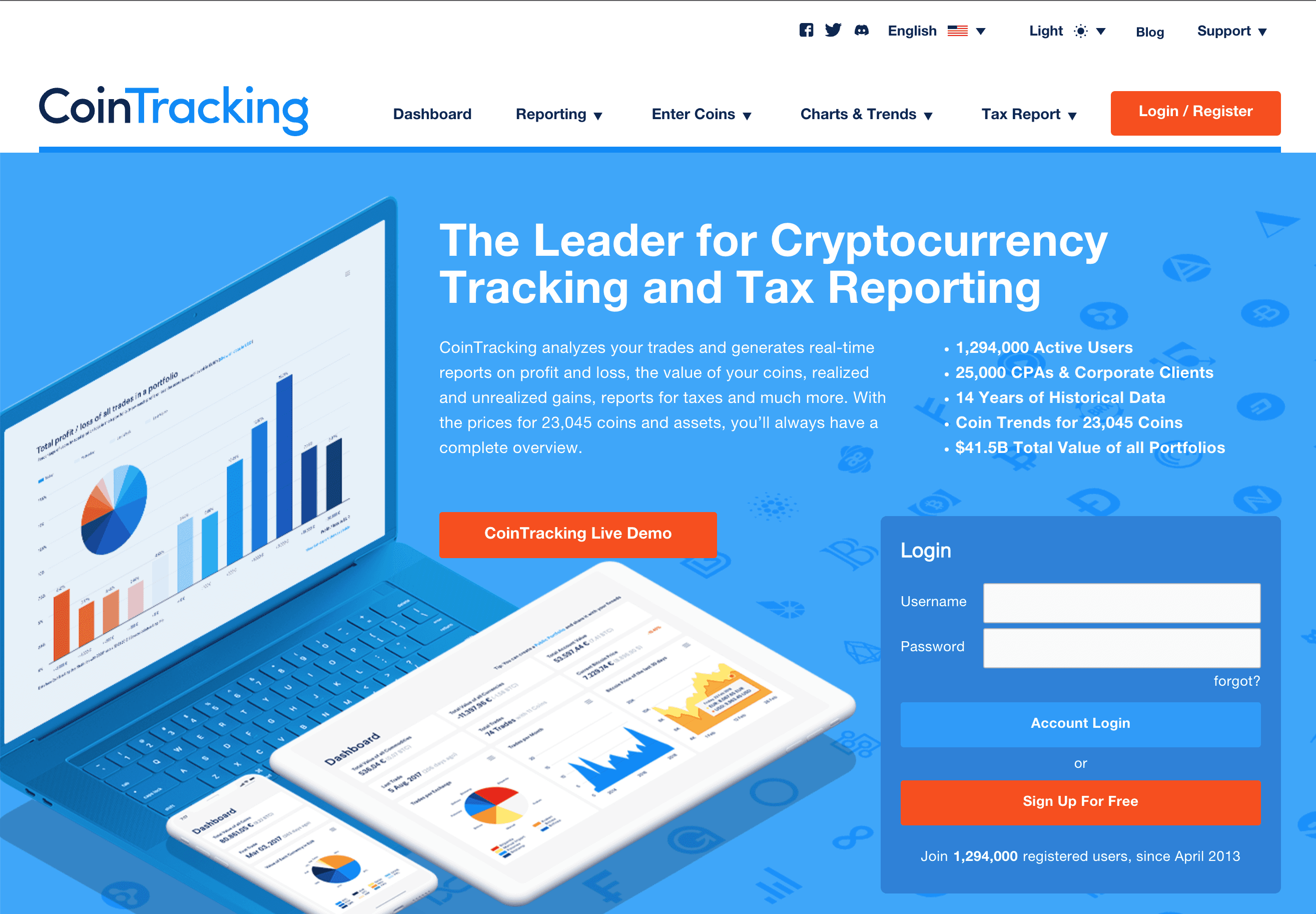

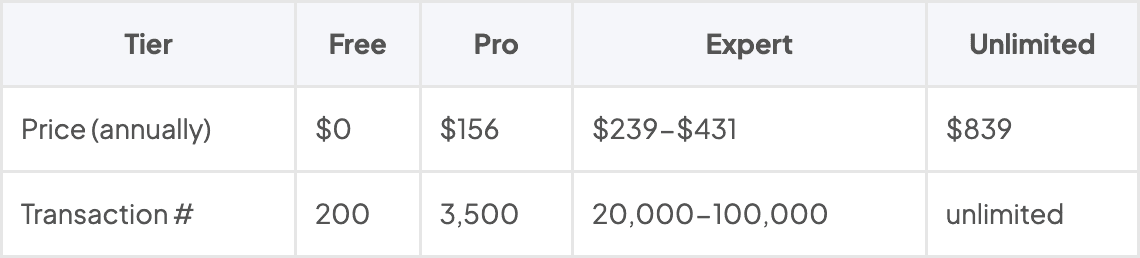

7. CoinTracking.info

CoinTracking.info has been around for over a decade and advertises itself as the world’s first crypto tax reporting tool and portfolio manager, with 1M+ users today. It’s clear that the website is among the older ones in the cohort, and it can appear a bit overwhelming and dense.

Through a service called CoinTracking Full-Service they can connect you with CPAs in the United States to assist with filing taxes. With CoinTracker, you have the ability to import data from Mt. Gox and other defunct crypto exchanges.

CoinTracking offers a lifetime license, which are expensive but possibly worth it in the long run.

Our recommendation

There are many factors that affect ones decision to go with one of these over another. For people with lots of transactions, that might play a bigger role. The specific chains or exchanges supported might also prove important, but as we’ve seen a lot of them support an extensive range. If you’re working with a tax accountant, they might also have a preference for one that lets them see your reports.

In the end, we recommend that you list out where your cryptocurrency related activity has happened, and start with any of the tools that support them all. If you’ve interfaced heavily with a certain DeFi protocol, make sure that it’s supported via direct import, instead of via CSV. To save money, it is advisable to also begin with any of the tools that allow for free imports before you need to purchase their offering.

Resources and links

Official IRS guidance on Digital Assets:

https://www.irs.gov/businesses/small-businesses-self-employed/digital-assetsTax loss harvesting:

https://www.investopedia.com/articles/taxes/08/tax-loss-harvesting.aspGuidance on claiming loss on assets worth $0.01:

https://www.irs.gov/pub/irs-wd/202302011.pdf

Disclaimer: All the information provided above is for informational purposes only and should not be considered as professional investment, legal, or tax advice. You should conduct your own research or consult with a professional financial advisor when investing.