Back

February 20, 2026

For years, Bitcoin holders have been told they're early, paranoid, or chasing a speculative fantasy.

A few days ago, the world's most powerful leaders at the Munich Security Conference essentially validated the thesis.

Ray Dalio explained it plainly in a piece that's now circulating across every corner of the internet: the post-1945 world order has officially broken down.

The old rules no longer apply and for anyone who's been holding Bitcoin and wondering when the rest of the world would see what they see...

This is that moment.

Every Monetary System Has an Expiration Date

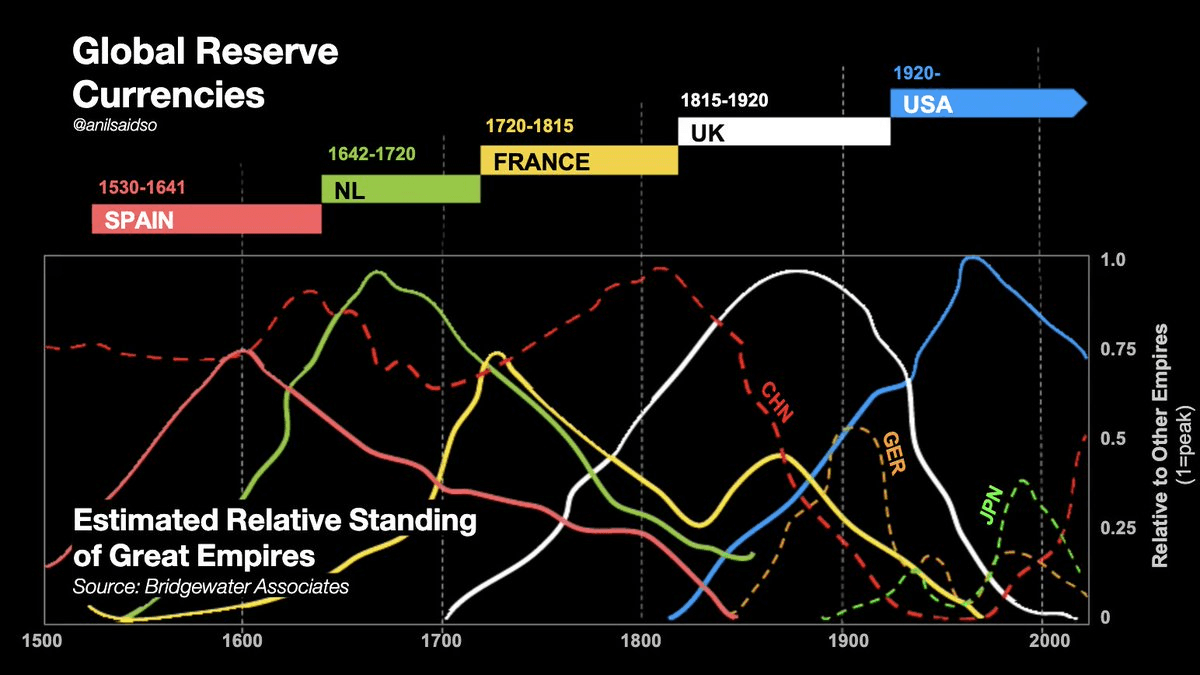

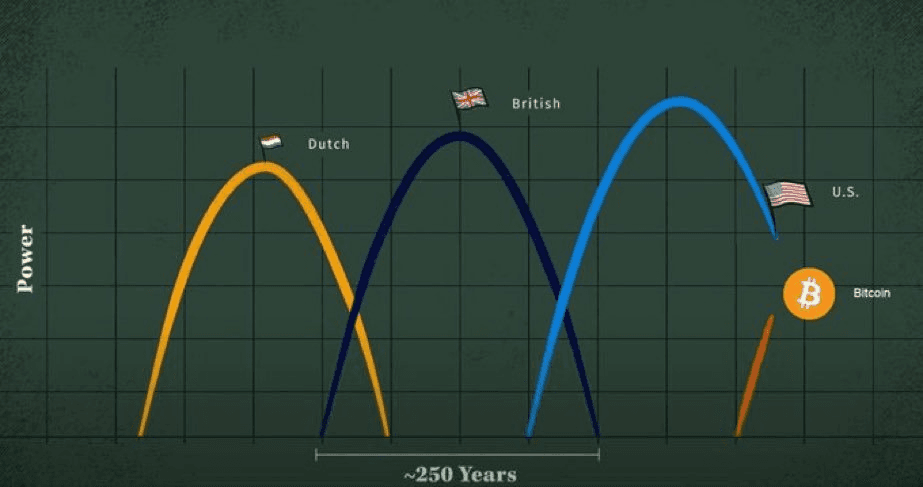

If history teaches us anything, it's that monetary systems don't last forever but they evolve alongside the geopolitical order that supports them.

The gold standard gave way to Bretton Woods. Bretton Woods gave way to the petrodollar system. Each transition was messy, contested, and only obvious in hindsight.

Right now we're likely in one of those transitions.

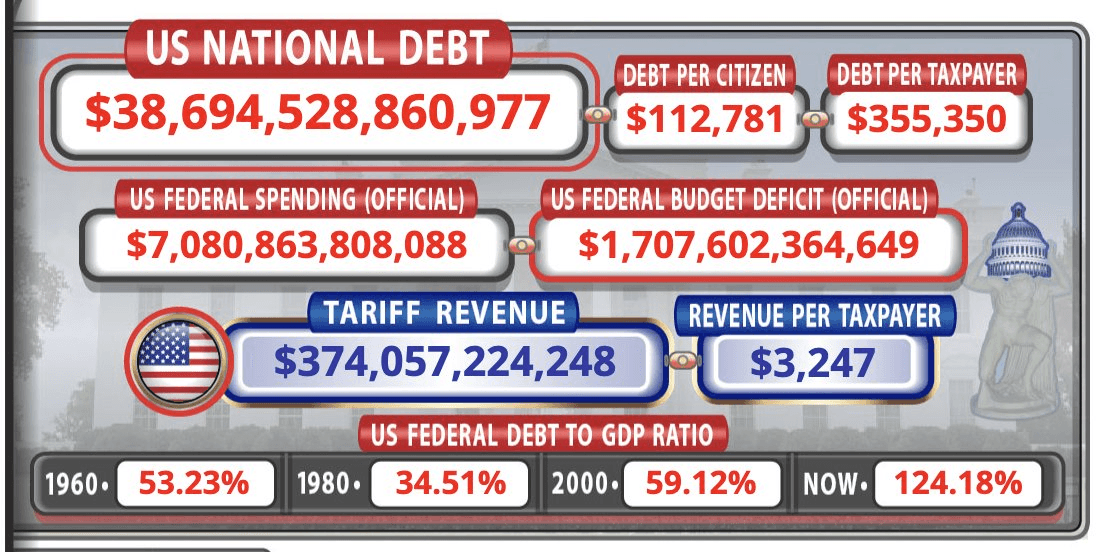

Fiscal deficits across major economies are expanding and central banks are navigating a world where the tools they relied on for decades (low rates, quantitative easing, forward guidance) carry diminishing returns and growing side effects.

Meanwhile, the currency itself is being used as a geopolitical instrument in ways that would have been unthinkable a generation ago.

The freezing of Russia's central bank reserves in 2022 was a watershed moment because of what it revealed structurally.

Any nation's reserves, held within another's financial system, can be switched off overnight and that realization didn't just land in Moscow but it landed in Beijing, Riyadh, New Delhi, and every treasury office in between.

Bitcoin Wasn't Built for the Old World

Bitcoin is often discussed in terms of price but its deeper significance is structural.

It's the first monetary asset in history that operates outside the control of any single nation, institution, or alliance.

In the old order defined by relatively stable alliances, predictable monetary policy, and broad trust in institutions those properties were intellectually interesting but not urgent.

In this new order defined by fragmented alliances, competing economic blocs, and the active weaponization of financial infrastructure those properties become profoundly practical.

Bitcoin is a hedge against the systemic instability that emerges when the rules of the game themselves are being rewritten.

What Forward-Thinking Holders Are Considering

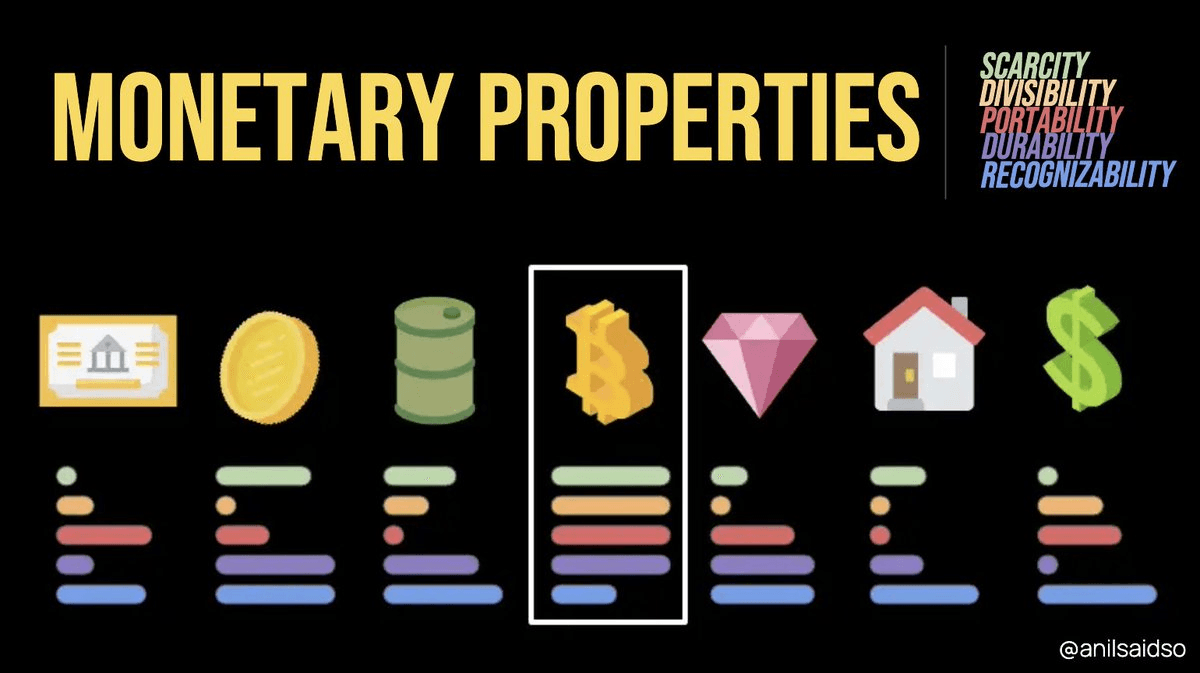

The emerging world order creates a set of conditions that favor assets with specific characteristics:

• Portability across borders

• Scarcity that can't be manipulated

• Settlement that doesn't depend on intermediaries

• And neutrality that isn't subject to any single government's foreign policy.

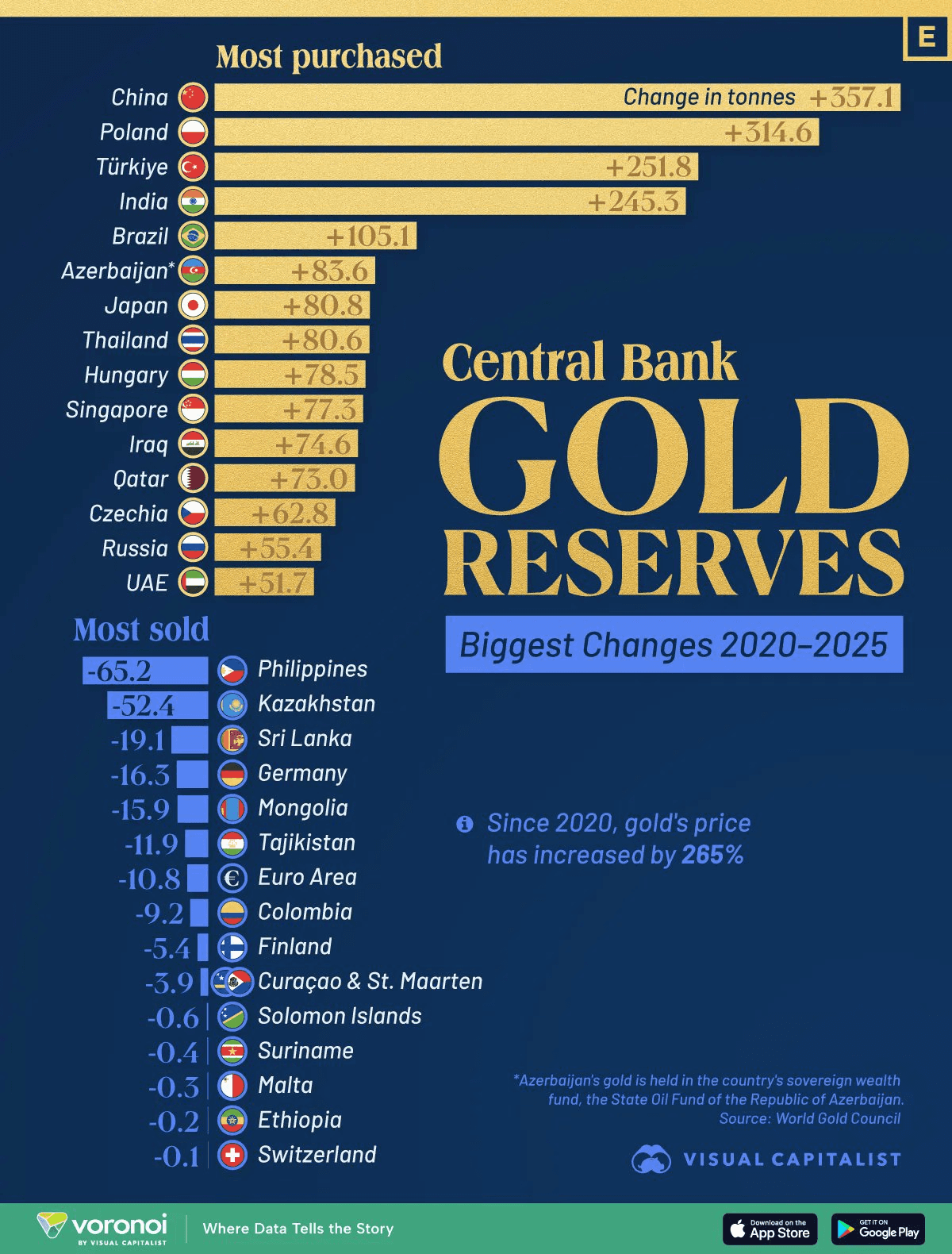

Gold has served some of those functions for millennia, and it's no coincidence that central bank gold purchases have surged in recent years.

But gold carries limitations in a digital, interconnected world as it's difficult to move quickly, expensive to verify, and impossible to send across the internet in seconds.

Bitcoin addresses each of those limitations while preserving the core property that gives gold its enduring value with credible scarcity enforced by something other than political will.

For holders thinking long-term, the question is shifting from:

"Will Bitcoin go up?"

to

"In a world where monetary systems are in flux, where do I want to hold value that no single actor can compromise?"

The Transition Won't Be Comfortable

None of this means the path ahead is smooth.

Periods of geopolitical transition are inherently volatile. Short-term drawdowns, regulatory uncertainty, and shifting narratives are features of these moments.

But it's worth distinguishing between the volatility of an asset and the fragility of a system.

Bitcoin is volatile but the legacy financial order, as the world's leaders themselves are now acknowledging, is fragile.

And those are two very different things.

The holders who navigate this period well will likely be the ones who understand that distinction and who can sit with short-term discomfort because they see the longer arc of what's unfolding.

Looking Ahead

The old assumptions of dollar dominance as a given, stable alliances as permanent and monetary policy as apolitical are being reconsidered everywhere in the world and what emerges on the other side is still being written.

But one thing feels increasingly clear: in a world that's moving away from centralized trust and toward multipolar competition, an asset that doesn't require you to trust any single counterparty is a forward-looking one.

The world order is changing.

The question worth asking is whether your positioning reflects the world as it was, or the world as it's becoming.

This article is for informational purposes only and does not constitute tax or investment advice. Cryptocurrency investments are volatile and risky. Always conduct your own research before making investment decisions.