Back

January 21, 2026

If you hold substantial Bitcoin, you've likely spent considerable time thinking about security.

You need fortress-level protection, but you also want financial flexibility when opportunities arise.

Hardware wallets solve both challenges and here's how to choose the right one for your needs.

What Are Hardware Wallets and Why Do They Matter

Hardware wallets are specialized physical devices that store your Bitcoin private keys completely offline.

Unlike software wallets on internet-connected devices, hardware wallets sign transactions in an isolated environment and expose your keys only when you physically approve a transaction.

This physical barrier between your keys and the internet makes remote theft virtually impossible.

Hardware wallets remain the gold standard for Bitcoin security and range from $50 to $200 with features from basic secure storage to advanced capabilities like air-gapped signing and multi-signature support.

Why Serious Bitcoin Holders Choose Hardware Wallets

The more Bitcoin you hold, the more thoughtfully you approach security.

But the motivations extend beyond simple asset protection. Bitcoin transactions are final and there's no customer service to call and no fraud department to reverse unauthorized transactions.

A single security failure (malware, phishing, or a SIM swap) can result in permanent total loss.

In March 2021, one investor lost $600,000 in Bitcoin after downloading a fake Trezor app from the iPhone App Store and the transaction was irreversible. With a legitimate hardware wallet used correctly, this type of attack would have been impossible.

Hardware wallets create a physical barrier between your keys and internet-based threats and this becomes especially important during high-value transactions.

When you're moving significant Bitcoin or establishing collateral arrangements, you're conducting exactly the kind of activity that bad actors specifically target.

Hardware wallets ensure that even if your computer is compromised during these sensitive moments, your private keys remain protected in the device's secure element.

Choosing the Right Hardware Wallet

Bitcoin-Only Wallets With Open-Source Transparency

For maximum security, Bitcoin-only wallets with fully open-source designs represent the gold standard.

These devices minimize attack surfaces by supporting only Bitcoin with no additional cryptocurrency code that could introduce vulnerabilities.

Here are the leading options:

Coldcard Mk4 ($150-$200): Fully air-gapped via MicroSD/NFC, dual secure elements, complete open-source transparency. Ideal for advanced users prioritizing maximum security.

Trezor Safe 5 Bitcoin-only ($169): User-friendly touchscreen, Shamir backups, fully open-source firmware and hardware. Excellent balance of security and usability.

BitBox02 Bitcoin-only ($149): Swiss-made with minimal attack surface and intuitive interface. Serious security without complexity.

Blockstream Jade ($65):Budget-friendly with air-gapped QR code signing and fully open-source design. Remarkable value for getting started properly.

Multi-Asset Options

If you hold both Bitcoin and other cryptocurrencies, these wallets offer broader support:

Ledger Nano X ($149-$199): Supports 5,500+ cryptocurrencies with Bluetooth connectivity. Note: secure element is closed-source, requiring trust in Ledger's implementation.

SafePal S1 ($50-$70): Affordable air-gapped option with QR code signing and partially open-source components.

What to Look for in a Hardware Wallet

Open-Source Code and Transparency

The most important factor is whether the firmware, software, and ideally hardware designs are fully open-source.

This means the code is publicly available for security researchers, developers, and users to audit for vulnerabilities, backdoors, or implementation flaws.

In Bitcoin's trust-minimized ecosystem, you're not trusting manufacturer claims but trusting mathematics and publicly auditable code that hundreds of security experts have reviewed over years.

Closed-source components (like Ledger's secure element) aren't necessarily insecure, but they require trusting the manufacturer's implementation rather than enabling independent verification.

Bitcoin-Only vs. Multi-Asset Support

Beyond open-source transparency, consider whether you want a Bitcoin-only wallet or multi-asset support.

Bitcoin-only wallets have smaller attack surfaces because each additional cryptocurrency requires additional code and potential vulnerabilities.

If you're primarily a Bitcoin holder, a Bitcoin-only device offers cleaner security. However, if you maintain meaningful positions in other cryptocurrencies, a quality multi-asset wallet provides good security with more flexibility.

Verifying Authenticity

Always purchase hardware wallets directly from the manufacturer's official website and never download wallet software from third-party app stores or unofficial sources.

The March 2021 incident where someone lost $600,000 through a fake Trezor app demonstrates why verification matters. Legitimate hardware wallet manufacturers will always direct you to their official websites and verified app downloads.

Understanding the Risks (and How to Mitigate Them)

Even with a quality hardware wallet, Bitcoin security requires understanding what can still go wrong.

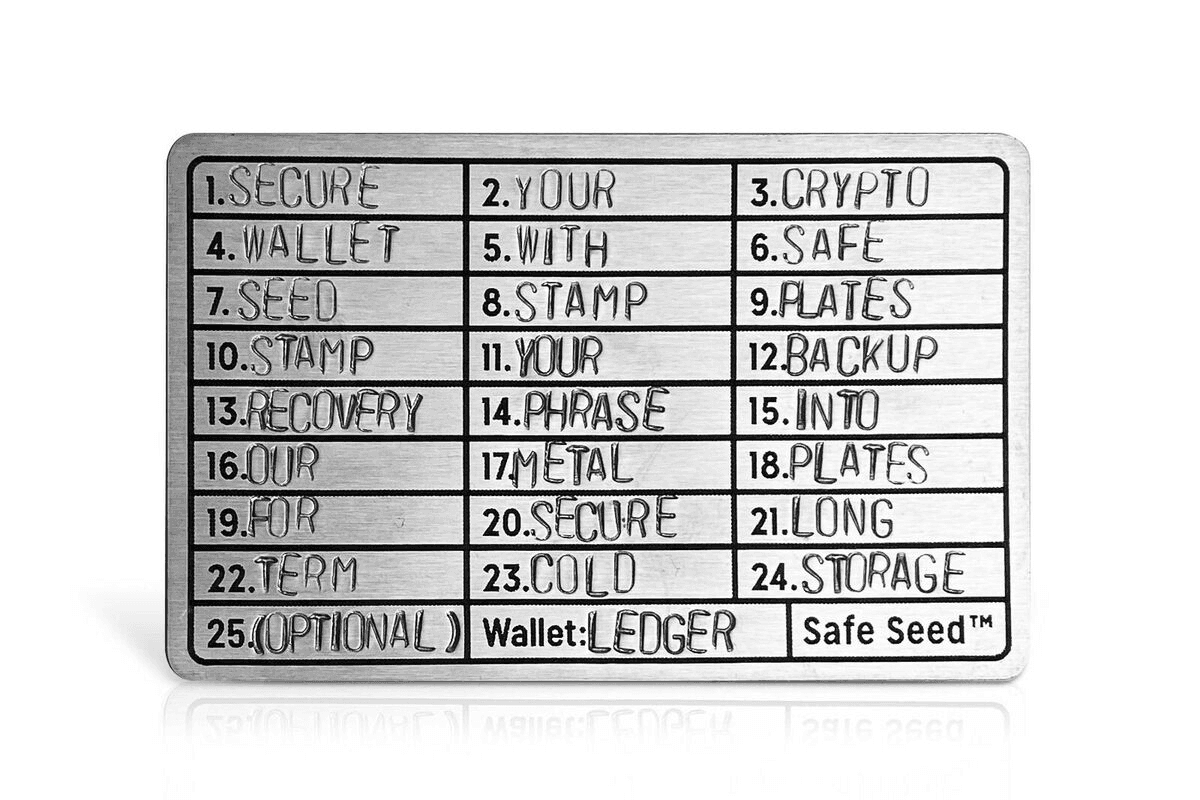

Seed Phrase Management Is Critical

Your seed phrase is your master key and if someone obtains it, your hardware wallet's security is completely bypassed.

This means one critical rule: never store seed phrases digitally.

No photos. No cloud storage. No password managers.

Instead, use metal backup solutions that are fireproof and waterproof, and consider splitting seeds across multiple geographic locations for maximum protection.

Physical Security Considerations

Hardware wallets protect excellently against remote hacking, but they don't protect against physical coercion or theft.

If someone knows you hold substantial Bitcoin and has physical access to you or your device, the security model changes.

Many holders with substantial positions use multi-signature setups requiring multiple devices stored in different locations. This makes it impossible for a single compromised device to result in loss.

Additional security measures:

Store hardware wallets and backup materials in secure locations like safe deposit boxes or home safes

Don't advertise your Bitcoin holdings publicly

Consider multi-signature arrangements for very large holdings

Firmware Updates and Verification

While rare, firmware vulnerabilities have been found in hardware wallets over the years and reputable manufacturers issue updates to address them.

However, firmware updates themselves create risk because you need to verify you're installing legitimate updates from the manufacturer, not malware disguised as an update.

Open-source wallets significantly mitigate this risk by allowing independent verification of firmware updates.

Balancing Security with Usability

There's a complexity trade-off to consider.

Advanced security features (like Coldcard's air-gapped operation) provide excellent security but require more technical understanding than simpler options like Ledger's USB connection.

The risk is that excessive complexity can lead to user error.

For substantial holdings, it's worth investing time to understand your hardware wallet thoroughly. Many Bitcoin holders practice with small amounts first before securing their main holdings.

Moving Forward

Today you have access to sophisticated security tools that genuinely balance protection with financial flexibility.

From fully open-source, Bitcoin-only hardware wallets to air-gapped signing and multi-signature arrangements, the tools for securing substantial holdings are mature and well-tested.

Security and financial flexibility aren't mutually exclusive and with thoughtful planning you can protect your Bitcoin while maintaining access to liquidity when opportunities arise.

Your Next Steps

Whether you choose a Coldcard for maximum security, a Trezor for balancing protection with usability, or a Jade to get started properly, the important step is moving your Bitcoin off exchanges into proper cold storage this month.

Here's what matters most:

Open-source code you can audit - Trust mathematics and not manufacturer claims

Physical isolation of your keys - Remote theft becomes virtually impossible

Verify authenticity - Only download from official manufacturer sources

Flexibility without compromise - Access liquidity through collateral lending while maintaining security

The investment in a quality hardware wallet ($65-$200) provides substantial peace of mind and preserves your financial options for years to come.

What questions do you have about hardware wallet security or getting started with cold storage? We're here to help you make the right choice for your situation.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments are volatile and involve risk. Always conduct your own research before making investment decisions.